Manage your Term Deposit

Renew or withdraw your Term Deposit online, without having to visit a branch.*

How will I know my Term Deposit is maturing?

- Based on your preferences, we’ll either mail or email you when your Term Deposit is maturing – and tell you in your Internet Banking message centre too

- Set up renewal or withdrawal instructions in advance online or in our app – and update them whenever you want to.

From the date of maturity, you’ll have 14 days (called the Grace Period) during which you can provide or change instructions. If no instructions are received after that time, the funds will be reinvested for the same term as previously at what might be a new interest rate. If the 14 days ends on a Sunday or public holiday, the Grace Period will end on the business day that immediately precedes it.

Manage your savings online

Compare renewal rates

Logon to check the rates and bonus rates on offer for a new term. You’ll get an extra 0.10% p.a if you renew online.2

Choose what to do

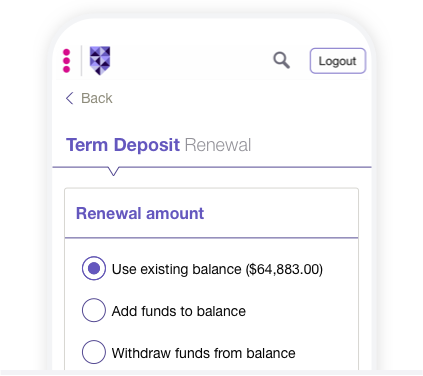

Reinvest some or all of your funds for another term. Or withdraw your funds and close the account.

Tell us what you want

You can provide maturity instructions at any time in Internet Banking or the app. Or wait until your account matures.

Special offers - up to:

Limited time: Up to 4.90% p.a. online offer for 24 months

How your interest adds up:

- 4.80% p.a. Fixed Rate Special Offer1 Term Deposit for a Term of 24 months

- PLUS, an additional 0.10% p.a. online bonus offer2 when you open or renew online

Up to 4.80% p.a. online offer for 12 months

How your interest adds up:

- 4.70% p.a. Fixed Rate Special Offer1 Term Deposit for Terms of 12 months

- PLUS, an additional 0.10% p.a. online bonus offer2 when you open or renew online

24-month Special Offer available from 10/03/2026 and 12-month Special Offer available from 10/03/2026, on Term Deposits opened or renewed by existing Bank of Melbourne personal or business customers. Available on deposits of $1,000 to $2,000,000 with interest paid monthly or at maturity. T&Cs Apply.

Not yet a Bank of Melbourne customer? Please contact a Bank of Melbourne Branch.

Deposit about to mature?

Manage your Term Deposit online choosing to renew or withdraw.

Get the Bank of Melbourne app

The Detail

Term Deposits Terms and Conditions and General Information (PDF 399KB)

*Managing Term Deposits online may not be available in some circumstances, such as when an account is held jointly with two signatories. See Online bonus rate T&Cs for other exceptions.

- Existing Bank of Melbourne personal and sole trader customers taking up a Special Offer Term Deposit.

- Opened, or renewed during the grace period, via Internet Banking, the App or by talking to us. Not available in Business Banking Online.

- Not available for Financial Institutions or Government customers.

- For renewing Term Deposits, customer-initiated instructions must be provided in the grace period.

- We reserve the right to withdraw, amend or extend the offer at any time.

- Rate and offer apply for a single term.

- Higher or lower rates may apply for subsequent terms.

- You must provide a minimum of 31 days’ notice to access funds prior to maturity (except in cases of hardship).

- If the deposit or any part of it is withdrawn early, an interest rate adjustment will usually apply.

- Term Deposits opened or renewed during the grace period via Internet Banking or the App only. Not available in Business Banking Online.

- The bonus offer will be applied in conjunction with any other rate offer that may apply.

- Not available for customers who are not able to open or renew via Internet Banking (e.g., some joint accounts), business customers except sole traders or Term Deposits held as security.

- For renewing Term Deposits, customer-initiated instructions must be provided in the grace period.

- We reserve the right to withdraw, amend or extend the offer at any time.

- Rate and offer apply for a single term.

- Higher or lower rates may apply for subsequent terms.

- You must provide a minimum of 31 days’ notice to access funds prior to maturity (except in cases of hardship).

- If the deposit or any part of it is withdrawn early, an interest rate adjustment will usually apply.