The Global Currency Card has closed

The Global Currency Card (GCC) has now closed.

We now offer a new travel card, the Bank of Melbourne Worldwide Wallet. If you had funds left to retrieve from your GCC account at the time of closure, you’ll find all the information you need below.

Claiming your funds

If you had an eligible Bank of Melbourne account at the time of closure:

Any remaining funds were transferred there in July 2021.

If you don’t have an eligible Bank of Melbourne account:

Contact the Travel Card team directly on 1300 804 266 (or +61 3 8536 7873 from overseas) to organise the transfer of any remaining funds to a nominated Australian bank account.

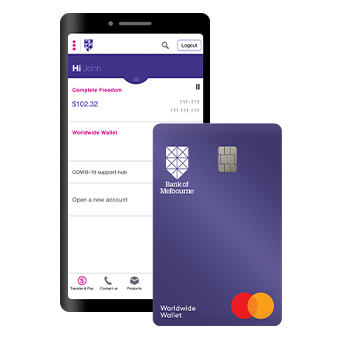

Introducing the Bank of Melbourne Worldwide Wallet

Our new travel card is a safe and smart way to pay. You can order online or pick one up from your local branch and activate it online.

- Fee-free shopping

Whether you’re home or away, you can avoid foreign transaction fees when you shop online. You’ll also pay zero ATM withdrawal fees at Global ATM Alliance ATMs around the world.2

- Rewarding perks

Access unforgettable experiences where you live or abroad with access to Priceless® Cities.3 Plus, get cashback when you shop overseas thanks to Mastercard® Travel Rewards.4

- Easy management

Enjoy the convenience of managing your travel card alongside your regular banking in the Bank of Melbourne App.

- Stress-free travel

Feel secure from fraudulent transactions with Mastercard Zero Liability protection.5 You can also kick back at one of over 1,000 airport lounges if your flight is delayed.6

FAQs

If you had an eligible Bank of Melbourne account at the time of closure, your remaining funds were transferred by the end of July 2021. Any remaining foreign currencies were converted into AUD at the applicable exchange rate prior to the transfer.

If you don’t have an eligible Bank of Melbourne account, contact the Travel Card team directly on

1300 804 266 (or

+61 3 8536 7873 from overseas) to organise the transfer of any remaining funds to a nominated Australian bank account.

The Detail

Global Currency Card

Information is current as at 6 November 2020. Bank of Melbourne – A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714, is the distributor of this product. Rev Australia Pty Ltd ACN 117 378 953 AFSL 401610 manages the Bank of Melbourne Global Currency Card product for Cuscal Limited ACN 087 822 455 AFSL 244116, an authorised deposit-taking institution and a member of Visa International. Cuscal Limited is the issuer of the product only and does not take deposits from you. Bank of Melbourne is not responsible for and does not guarantee this product or card, your ability to access any prepaid value or the use of this product or card. Amounts held on the product do not represent a deposit with, or any other liability of Bank of Melbourne or any company in the Westpac Group.

Worldwide Wallet

You should read the

Bank of Melbourne Worldwide Wallet Product Disclosure Statement (PDF 325KB),

Internet and Phone Banking Terms and Conditions (PDF 498KB) and

Bank of Melbourne Retail and Business Banking Financial Services Guide (PDF 150KB) before making a decision and consider whether these products are appropriate for you. This information does not take into account your personal objectives, financial situation or needs and you should consider its appropriateness having regard to these factors before deciding to acquire these products.

A target market determination has been made for this product. Please visit bankofmelbourne.com.au/tmd for the target market determination.

Information will be disclosed to third parties about you and your Product, or transactions made by you with the Product, as necessary for the service provision or as required by law. Bank of Melbourne’s Privacy Statement explains our commitment to the protection of your personal information or you can learn more by calling 13 22 66.

2. No ATM withdrawal fee at Westpac Group, select Westpac Group partner ATMs in Australia and via Global ATM Alliance partners. Other fees and charges may be payable.

3. For Priceless ® Cities terms of use, visit priceless.com/terms/en_AU.

4. Individual terms and conditions (T&Cs) apply to each offer. The T&Cs of each offer are specified on mtr.mastercardservices.com/en/i/20657. Cashback is available on international spend only. Cashback is not available for any local or domestic spend (in Australia). Cashback applies to qualifying transactions only (where a cardholder makes a purchase that meets the cashback offers published criteria and the specific T&Cs, in the local currency stipulated). Cashback is not processed immediately and will not reduce the purchase price of goods and services at the point of sale. The processing of cashback offers is undertaken by automated Mastercard systems and will appear as a credit on your next Bank of Melbourne card statement. Mastercard Travel Rewards is operated by Mastercard in agreement with Bank of Melbourne. For the Worldwide Wallet, the cashback processed will depend on the currencies available on your card and the location of your purchase. Examples of how a rebate may be processed are: If the destination currency is listed as a currency into which you can load funds onto your Card, the rebate will be credited as a single amount to the destination currency regardless of whether you have any funds available in that currency; or If the destination currency is not listed as a currency into which you can load funds onto your Card, the rebate will be credited to the local currency in the country in which your Prepaid Card was issued, i.e. AUD.

5. You will be reimbursed for any unauthorised transactions, provided that you have not contributed to the loss, exercised reasonable care in protecting your card and account, and promptly notified Bank of Melbourne upon becoming aware of loss, theft, or misuse.

6. You must register each flight before its scheduled departure time. A flight is defined as a single scheduled airline flight under a single flight number. Delay must be officially announced by the airline and reported to our flight status data service provider. Flight Delay Pass is only available at selected airport terminals. If you are under 18 years old, you must be accompanied by an adult (18 years of age and older) to enter participating lounges. Access to and use of the Flight Delay Pass is subject to T&Cs which may change from time to time. Visit flightdelaypass.mastercard.com/worldwidewallet for the T&Cs and the list of participating lounges.

Internet connection may be needed to make purchases using Google Pay or Samsung Pay and normal mobile data charges apply.

Google Pay is a trademark of Google Inc.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

Mastercard and Priceless are registered trademarks, and the circles design is a trademark of Mastercard International Incorporated.

A target market determination has been made for this product. Please visit bankofmelbourne.com.au/tmd for the target market determination.

Information will be disclosed to third parties about you and your Product, or transactions made by you with the Product, as necessary for the service provision or as required by law. Bank of Melbourne’s Privacy Statement explains our commitment to the protection of your personal information or you can learn more by calling 13 22 66.

2. No ATM withdrawal fee at Westpac Group, select Westpac Group partner ATMs in Australia and via Global ATM Alliance partners. Other fees and charges may be payable.

3. For Priceless ® Cities terms of use, visit priceless.com/terms/en_AU.

4. Individual terms and conditions (T&Cs) apply to each offer. The T&Cs of each offer are specified on mtr.mastercardservices.com/en/i/20657. Cashback is available on international spend only. Cashback is not available for any local or domestic spend (in Australia). Cashback applies to qualifying transactions only (where a cardholder makes a purchase that meets the cashback offers published criteria and the specific T&Cs, in the local currency stipulated). Cashback is not processed immediately and will not reduce the purchase price of goods and services at the point of sale. The processing of cashback offers is undertaken by automated Mastercard systems and will appear as a credit on your next Bank of Melbourne card statement. Mastercard Travel Rewards is operated by Mastercard in agreement with Bank of Melbourne. For the Worldwide Wallet, the cashback processed will depend on the currencies available on your card and the location of your purchase. Examples of how a rebate may be processed are: If the destination currency is listed as a currency into which you can load funds onto your Card, the rebate will be credited as a single amount to the destination currency regardless of whether you have any funds available in that currency; or If the destination currency is not listed as a currency into which you can load funds onto your Card, the rebate will be credited to the local currency in the country in which your Prepaid Card was issued, i.e. AUD.

5. You will be reimbursed for any unauthorised transactions, provided that you have not contributed to the loss, exercised reasonable care in protecting your card and account, and promptly notified Bank of Melbourne upon becoming aware of loss, theft, or misuse.

6. You must register each flight before its scheduled departure time. A flight is defined as a single scheduled airline flight under a single flight number. Delay must be officially announced by the airline and reported to our flight status data service provider. Flight Delay Pass is only available at selected airport terminals. If you are under 18 years old, you must be accompanied by an adult (18 years of age and older) to enter participating lounges. Access to and use of the Flight Delay Pass is subject to T&Cs which may change from time to time. Visit flightdelaypass.mastercard.com/worldwidewallet for the T&Cs and the list of participating lounges.

Internet connection may be needed to make purchases using Google Pay or Samsung Pay and normal mobile data charges apply.

Google Pay is a trademark of Google Inc.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

Mastercard and Priceless are registered trademarks, and the circles design is a trademark of Mastercard International Incorporated.