Latest Scams and Alerts

Scammers are constantly evolving by using different tactics. Check out examples of the latest scams and security alerts.

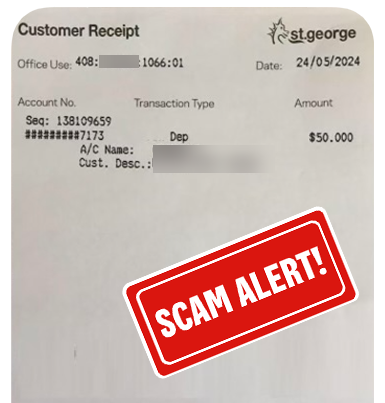

June 2024 - Fake Receipt Scams

Be wary of fake receipts

We've received varied reports of customers claiming to have received a branch receipt for items purchased through an online marketplace.

These receipts, which have been altered, are given to a seller as proof of payment to collect an item.

Be Aware - Receipts, whether digital or a printed receipt, could be manipulated to appear consistent with the claimed transaction. Your primary confirmation for receipt of payment should always be by logging into Internet Banking or the App, and verifying the funds have been received in to your account.

If you cannot validate the money is in your account, and the purchaser produces a receipt, be wary as this may be a scam. If the payment is delayed, do not part with the item until you have confirmed the deposit has been received into your account.

What to do next

If you have received an email, SMS or other request that you have identified as potentially fraudulent or a scam account, it’s always a good idea to report this through to us, before deleting it from your inbox and deleted items or your device.

Forward a copy to hoax@bankofmelbourne.com.au or 0447 214 629.

Nov 2023 - SMS Scams

Be alert to unexpected scam messages

This scam SMS claims to be associated with the telco network outage on the 08/11/2023. Scammers often attempt to take advantage of widespread outages, natural disasters and other topical situations to steal your personal and financial information.

Be aware - If you click the link in this SMS, you will be taken to a phishing website which attempts to steal your personal and banking information.

Please be alert to this and always use genuine apps or websites to validate the information being provided. Remember, never logon to your Internet Banking via a link received in an email or SMS.

What to do next

If you have received an email, SMS or other request that you have identified as potentially fraudulent or a scam account, it’s always a good idea to report this through to us, before deleting it from your inbox and deleted items or your device.

Forward a copy to hoax@bankofmelbourne.com.au or 0447 214 629.

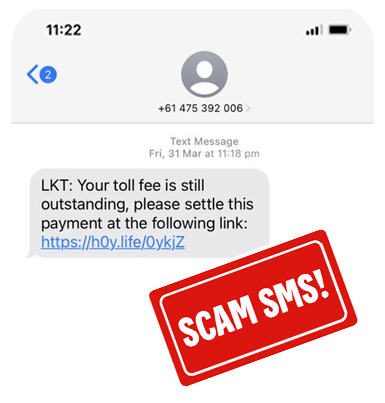

March 2023 - LinkT Scams

Be alert to fake messages requesting toll payments

This SMS scam claims to be from Linkt, stating you have unpaid toll fees.

Linkt advise if you have received a communication from someone claiming to be Linkt and it appears to be suspicious, delete it and do not click on any links.

You can visit the Linkt website to report Linkt SMS scams.

What to do next

If you have received an email, SMS or other request that you have identified as potentially fraudulent or a scam account, it’s always a good idea to report this through to us, before deleting it from your inbox and deleted items or your device.

Forward a copy to hoax@bankofmelbourne.com.au or 0447 214 629.

Oct 2022 - SMS Scam

Be alert to receiving messages claiming to be one of your parents

This SMS Scam starts by receiving a message from a sender name of "Dad" or "Mum", a common ploy scammers are currently using to establish your trust, in the hope you will action their request. Your mobile device may group this message into your conversation history, if the sender name and a stored contact match one another.

Wording may slightly vary, however should you receive a request to send money to a family member unexpectedly, always call them on their trusted number (one you've previously spoken to them on) to confirm the request.

What to do next

If you have received an email, SMS or other request that you have identified as potentially fraudulent or a scam account, it’s always a good idea to report this through to us, before deleting it from your inbox and deleted items or your device.

Forward a copy to hoax@bankofmelbourne.com.au or 0447 214 629.

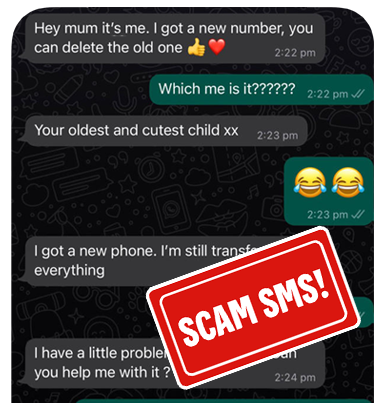

Aug 2022 - SMS Scam

Be alert when receiving new messages claiming to be from your child

This particular scam, commonly received via WhatsApp or other messaging apps, is designed to convince parents their child has a new phone number. The claimed child does not provide their name, but indicate they are a part of the family by responding with wording like "Your oldest and cutest child".

The scammer eventually asks to borrow money, claiming issues with Internet Banking due to the phone number transfer.

It's always important to validate the person requesting money is legitimate. Call their old number, regardless of any claims the sender may make or check in with other family members to see if they have been advised of a change in number.

What to do next

If you have received an email, SMS or other request that you have identified as potentially fraudulent or a scam account, it’s always a good idea to report this through to us, before deleting it from your inbox and deleted items or your device.

Forward a copy to hoax@bankofmelbourne.com.au or 0447 214 629.

Support and learn more