Track my pre-settlement application: 3 steps

The fast and simpler way to review, accept and upload your home loan documents online.

Received your loan offer? Congratulations!

This easy-to-follow guide helps you progress to settlement online in your own time. Feel free to save and come back later.

Your guide to becoming settlement-ready

To lower the chance of delay, finish all 3 steps well before Settlement Day.

Accept your loan offer online

Let’s seal the deal. Sign into Internet Banking, and follow the steps.

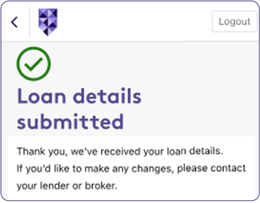

Submit your Loan Authority form

Nominate your account, set up repayments and share your solicitor’s details.

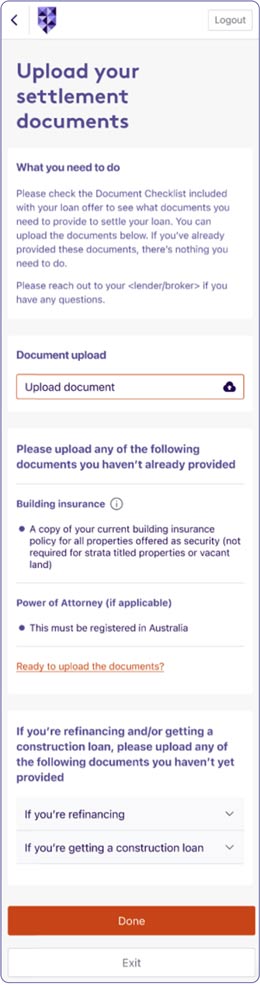

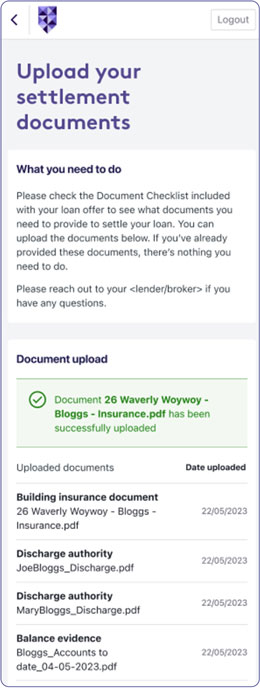

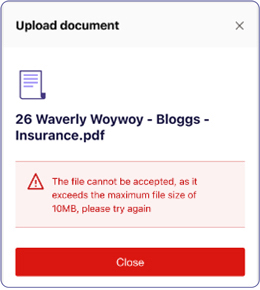

Upload settlement documents

Check your list of documents we still need, follow the prompts and upload them. Simple.

Frequently asked questions

All you need to know about checking, accepting and uploading documents online.

Before you get started

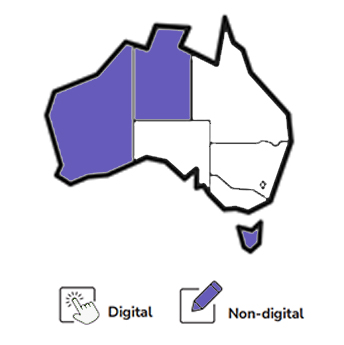

You can accept all, or most, of your documents online.

- Simple. Review in your own time, clarify with your Lending Manager or Broker before signing.

- Direct. Connects to our system for instant access right up to settlement.

- Faster. No manual processing, less chance of settlement delays.

- Secure. All in one place, can’t get lost in the mail.

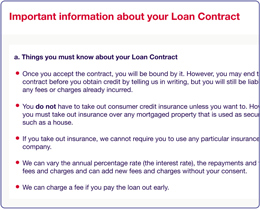

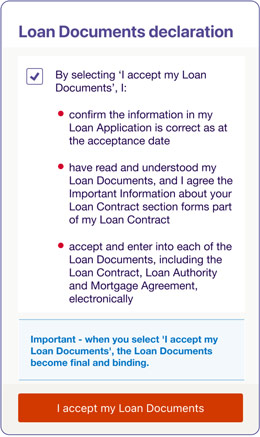

1. Accepting your Loan Offer online

Sign into Internet Banking, and follow these steps:

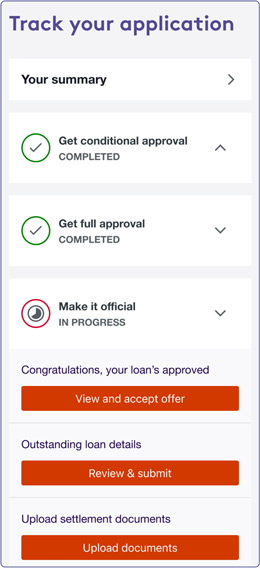

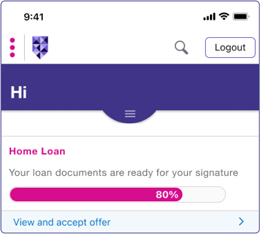

On the main page, go to your home loan progress bar > Under Make it official > View and accept offer

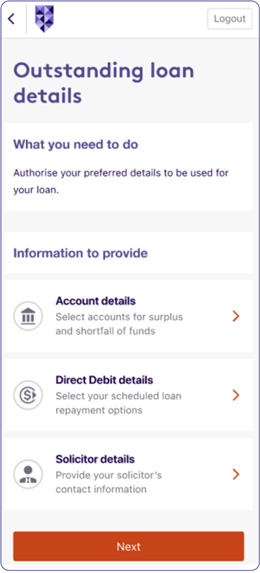

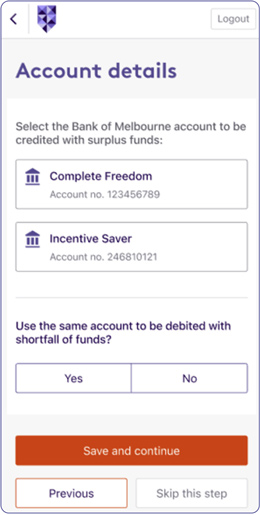

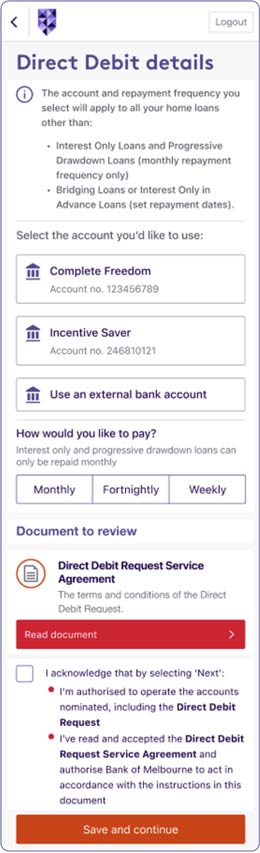

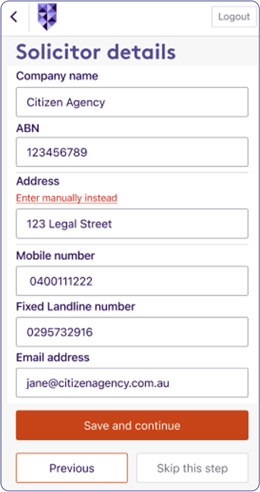

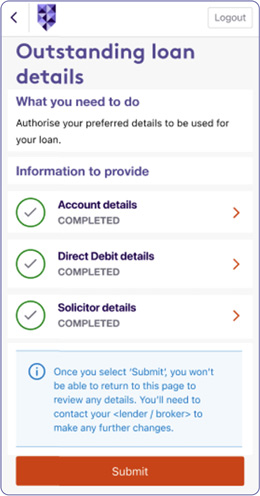

2. Submitting your Loan Authority form online

Nominate an account, set up your repayments and share your solicitor’s details.

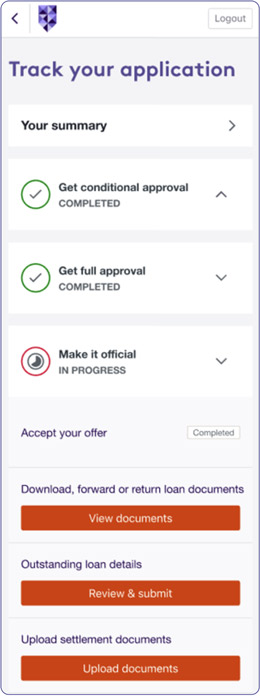

- Go to Home Loan > Select Continue > Track your application

- Select Make it official

- Under Outstanding loan details

- Select Review and submit

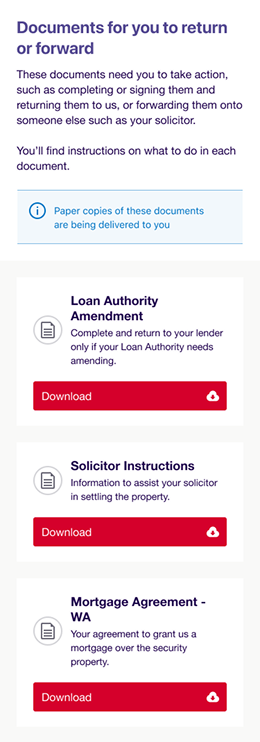

3. Upload settlement documents

Sign into Internet Banking, check your list of documents, follow the prompts and upload them. Simple.

- On the main page, go to your home loan progress bar and select Continue > Track your application

- Select Make it official > Upload settlement documents > then select the Upload documents button.

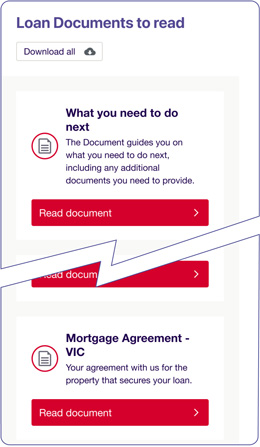

FAQs about pre-settlement documents

- Check your loan offer cover letter for the Document Checklist.

- Or go to the Track your application dashboard, go to Make it official > Upload settlement documents to see the list.

Need help finding them? Ask your Lending Manager or Broker.

FAQs about setting up Internet Banking

During your home loan application, we’ll ask if you want to use Internet Banking. If you say “yes” we’ll set it up for you. You also need to agree to get emails and texts from us so we can send you your Internet Banking details.

Your Customer ID

Never been a Bank of Melbourne customer before? We’ll create a Customer ID for you to use Internet Banking. If you have been a customer before, you might already have a Customer ID, and we’ll just enable your Internet Banking profile.

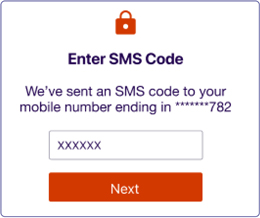

Your temporary SMS password

If you’re new to Internet Banking, we’ll send you a temporary password by SMS so you can sign in for the first time.

Protect your deposit from scammers

Keep an eye out for scammers pretending to be someone you trust, like your conveyancer, Lending Manager or Broker. If they ask you to send money to a new bank account, don’t do it right away. First, speak to the person you know using their original phone number or email to double-check. Never use contact details from a suspicious message.

Track it in the Bank of Melbourne App

The Detail

Conditions, credit criteria, fees and charges apply. Based on Bank of Melbourne’s credit criteria, residential lending is not available for Non-Australian resident borrowers. Interest rates subject to change. Before making a decision, it’s best to read the terms and conditions.

Loan Accounts – Charges for specific services and accounts (PDF 360KB)

This information is general in nature and has been prepared without taking your objectives, needs and overall financial situation into account. For this reason, you should consider the appropriateness of the information to your own circumstances and, if necessary, seek appropriate professional advice.