Home loans: to switch or not to switch?

Refinancing or “switching” your home loan used to feel like a lot of work, but now it's much more streamlined – you can even apply for your home loan online.

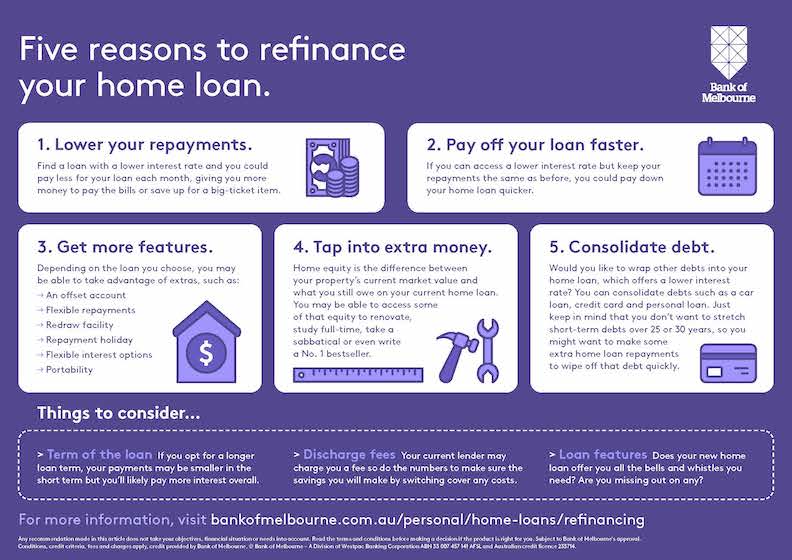

Here are some of the main reasons for refinancing

Refinancing means replacing your home loan with a new one - whether you’re refinancing to a new product with your current lender or switching to another bank.

Here is a helpful infographic to download too. (PDF 37KB)

1. Lower your repayments

Most borrowers switch loans because they’ve found a better interest rate. It’s pretty straightforward: the lower the interest rate, the lower your repayments will generally be, leaving more money in your pocket to pay the bills, plan a holiday or save up for a big-ticket item.

2. Pay off your loan faster

If you can access a lower interest rate but keep your repayments the same as before, you could pay down your home loan quicker. Now could be a good time to make a switch.

3. Life’s changed and you want your loan to match

There’s more to a mortgage than the rate. Today’s loans range from the basic to the highly tailored, with extras and options to help you save as much money as you can over the years or have more flexibility with how you pay your mortgage. Generally, extra features and options attract a higher interest rate and fees than a basic mortgage product.

More bells and whistles:

- Offset account. This is a bank account linked to your loan, where every dollar you have in the linked transaction account “offsets” an equal amount on your home loan. That means if you have $5,000 in your offset account, you won’t have to pay interest on $5,000 of the balance owing in your home loan account. An offset facility is a selectable feature on some home loan products.

- Extra repayments. Some variable loans allow you to make unlimited extra, flexible repayments at no extra fee, while fixed term loans often cap the amount you can pay in advance.

- Redraw facility. If you’ve made any extra repayments, redrawing means you can withdraw as and when you need to. Thresholds apply for fixed rate home loans.

- Repayment holiday. This lets you take a break from your repayments for a set amount of time – as long as you’ve made extra repayments on your loan. It can be handy if you’re going through a major life event, like having a baby.

- Flexible interest options. Most people opt for a variable loan but some like the certainty of knowing exactly how much their monthly repayments will be. The option is always available to split the loan and get the best of both: a variable rate and a fixed rate.

- Portability. If you want the option of staying with your current lender in the future, a “portable loan” means you can move it to another property without the expense and extra admin of setting up a whole new loan.

- Packaging. Most lenders offer an all-in-one package, combining your home loan, credit card, transaction account and more, which attracts an interest rate discount on the home loan.

- Support. Your home loan is long term – a lot can change over time. Truthfully, some lenders are better than others at looking after their customers when life throws a curve ball, such as financial hardship, a pandemic or a natural disaster.

A simpler loan

Your current loan might have a variety of features you’re paying for, but not using, such as an offset account. Our Basic Home Loan has minimal fees but still lets you get ahead. It allows you to make unlimited extra repayments and allows you to redraw those funds should you need some extra cash later.

4. Tap into extra money

Can you access much of the equity in your home? Home equity is the difference between your property’s current market value and what you still owe on your current home loan. So, if you have a home valued at $800,000 and a mortgage balance of $500,000, you have $300,000 equity in your home. If your new home loan allows you to borrow up to 80% of your home’s value ($640,000), your usable equity is $140,000 (total equity of $640,000 minus the $500,000 you owe on your mortgage).

So that’s $140,000 you could use. Maybe you want to renovate, study full-time, take a sabbatical or write a No. 1 bestseller.

5. Bring all your debts under one lower rate

Refinancing could also be a good opportunity to consolidate any debts you have – such as personal loans, car loans and credit cards – into a new home loan with a lower interest rate. Not only can you save on interest, your finances may also be easier to manage under the one repayment.

Just keep in mind that you don’t want to stretch short-term debts over 25 or 30 years, so you might want to make some extra home loan repayments to wipe off that debt quickly.

Switching is easier than it used to be

If you bought your home a while ago, you’ll be pleased to learn that the introduction of online applications allow you to go at your own pace. Some lenders, like Bank of Melbourne, can even offer refinance approval in a matter of days, depending on the borrower’s situation. They’ll also do a lot of the work for you: settle your new loan and discharge you from your old one by paying the balance with your new loan funds, including any fees and break costs. They’ll even shift the property title from the old loan to your new loan.

Before you sign on the dotted line…

As with everything money-related, you have to weigh up the pros and cons. Here are some things to consider:

- Loan discharge fees. Your current lender will likely charge you a fee to release your loan.

- Fixed term break costs. If you have a fixed interest rate loan and want to refinance, your current lender might also charge a break cost based on how long you have left on your loan. Do the numbers to make sure the savings you’ll make by switching will cover it, and then some. You can check the T&Cs of your current fixed loan, or your current lender should be able to tell you your break costs.

- Your new lender’s application process might include a lending establishment fee, a credit score check and an in-person home property valuer fee.

- When looking for a lower interest rate, remember to check the “comparison rate” of both loans, as it includes general fees and charges over the life of the loan.

- Extending the loan term. If you opt for a longer loan term, your payments may be smaller in the short term, but you will likely end up paying more interest in the long term. Use our repayment calculator to check.

- Losing existing home loan features. Just as a new loan product could offer better features, you may lose out on some that came with your old loan.

- Turning short-term debt into long-term debt. Unless you make a plan to pay off the amount of high-interest debt you’ve rolled into your loan (like that 3-year car loan) within a similar term, you could end up paying a lot more for the car in total interest in the long run.

- If you paid lenders mortgage insurance (LMI) as part of your current home loan (you borrowed more than 80% of your property’s value), it’s likely that your LMI isn’t transferable to your new loan. Which means if you plan to refinance over 80% of your property’s value, you’ll likely have to pay LMI again with your new lender.

So, all food for thought. Do a little refi-research and some robust comparison and then you could be on your way to paying off your home sooner.

Refinance with us

Switch your home loan to Bank of Melbourne and see how much you could save.

What are the costs to refinance?

Refinancing your home loan has the potential to make you some hefty savings, it’s important to weigh up the costs involved.

Start your application online

Our Concierge will call you once you've submitted your application to help handle the rest of the process.

The Detail

Any recommendation made in this article does not take your objectives, financial situation or needs into account. Read the terms and conditions before making a decision if the product is right for you. Subject to Bank of Melbourne's approval. Conditions, credit criteria, fees and charges apply, credit provided by Bank of Melbourne.

LVR stands for the initial loan to value ratio. LVR is the amount of your loan compared to the Bank’s valuation of your property offered to secure your loan expressed as a percentage. Home loan rates for new loans are set based on the initial LVR and won’t change during the life of the loan as the LVR changes.

Advantage Package: Terms & Conditions (PDF 1MB) apply. A $395 annual package fee applies and is payable from an eligible Bank of Melbourne transaction account. Before deciding to acquire a Bank of Melbourne transaction account, read the terms & conditions, and consider if the product is right for you.