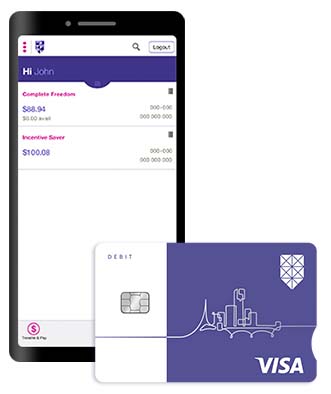

Complete Freedom Account + Visa Debit Card

You could get $50 cashback with our no-account-keeping fee, feature-packed Complete Freedom account. Minimum spend required. Read on to find out more.

Get $50 cashback on your new account

Open a new Complete Freedom account by 30 September 2025. Add your new Bank of Melbourne Visa Debit Card to your mobile wallet.

For new account holders who’ve not held a Complete Freedom account in the past 2 years.

Within 15 days of opening your account, spend a total of at least $50. The purchase(s) must be in person and contactless.

Mobile wallet only, through Tap & Pay.

Then, within 60 days of you meeting the spend requirements we'll deposit $50 into your Complete Freedom account.

Customers aged 18+ only. T&Cs apply*

Freedom and control

Safer shopping with your Digital Card

It's a digital version of your debit card, available in the Bank of Melbourne App. Use it just like your physical card to shop online, pay bills, and set up your recurring card payments. The dynamic CVV refreshes in your App every 24 hours – making your card details even more secure and reduces the risk of fraudulent card activity by over 50%.

$0 international transfer fees

AUD $0 fee per transaction when you send foreign currency overseas via Internet Banking.

Internet and Mobile Banking

Manage your banking needs wherever you are with Internet Banking and features such as Quick Logon and Push notifications via the Mobile App. For more information please read Internet and Mobile Banking T&Cs (PDF 471KB).

Safe and secure banking

Card Lock

Instantly put your card on temporary lock if it's lost, stolen, or misplaced to reduce the risk of unauthorised transactions.

Notifications

Choose the alerts you want to receive to get push-notifications straight to your phone to monitor your account activity.

Fraud money back guarantee

We ensure that customers will be reimbursed for any unauthorised transactions provided that the customer has not contributed to the loss and contacted Bank of Melbourne promptly.3

Are you under 18? Get a $50 kickstart

With an Incentive Saver savings account and a Complete Freedom transaction account. Ends 30/09/2025. New customers only. T&Cs apply.

Get rewarded for banking with us

Your Visa Debit Card gives you access to great offers and benefits from some of Australia's best-known brands as soon as you've activated your card.

Shop through ShopBack. Get Cashback.

Link and pay with your eligible Bank of Melbourne debit card to get exclusive bonus Cashback when you shop on the new Bank of Melbourne Lounge on the ShopBack app.

The Detail

Read the Terms and Conditions (PDF 681KB), including for fees and charges that may apply, before making a decision and consider if it is right for you.

1. To be eligible for a Visa Debit Card, you must have an Australian residential address and be 14 years old or over.

2. My Offers Hub is available to eligible consumer debit and credit card customers only.

*The $50 Cashback Promotion Terms and Conditions

This promotion runs from 30 June 2025 to 30 September 2025.

To be eligible you must:

- Be 18 years of age or older

- Not have held a transaction account with Bank of Melbourne in the last 2 years (applies to both account holders for joint accounts)

- Open a new Complete Freedom account (excludes Concession account) with a linked Visa Debit

- Add your new Visa Debit to a mobile wallet. Then, within 15 days of opening your new account use it to make in-person contactless payments that:

- Total $50 or more

- Are settled (not pending).

- Keep the account open for a minimum of 60 days after your eligible contactless payment.

Transactions that are not eligible:

- Using the physical card in-store, online or in-app

- ATM transactions

- BPAY

- EFTPOS cash out only transactions

- Gambling transactions

- Transactions made by credit card.

If you meet the above:

- You're eligible for a one-time $50 payment, regardless of the number of accounts you hold

- The $50 payment will be made to your Complete Freedom account within 60 days of you meeting all Terms and Conditions and eligibility criteria.

- If you open more than one Complete Freedom account, the $50 cashback will be made to one account only. It will be to the first one opened and active, whether a sole or joint account.

This promotion may be varied or withdrawn at any time. It is available in conjunction with any other offer.

Read the Apple Pay Terms and Conditions (PDF 31KB) before making a decision and consider if it is right for you. To use Apple Pay you will need an eligible card and a compatible device with a supported operating system. See our Apple Pay FAQs for more information. Apple, the Apple logo, Apple Pay, Apple Watch and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Read the Google Pay Terms and Conditions (PDF 30KB) before making a decision and consider if it is right for you. To use Google Pay you will need to use a compatible device with a supported operating system. See our Google Pay FAQs for more information.

Read the Samsung Pay Terms and Conditions (PDF 29KB) before making a decision and consider if it is right for you. To use Samsung Pay you will need to use a compatible device with a supported operating system. See our Samsung Pay FAQs for more information.